Quick Guide: Conducting an Internal Audit within Your Organization

- BryMar Crew

- Aug 8, 2024

- 3 min read

Internal audits are a critical tool for assessing the effectiveness of internal controls, identifying risks, and ensuring that your organization remains compliant with regulatory standards. Even if you don’t have a formal audit team, your accounting staff can play a key role in conducting thorough and effective audits. This guide outlines the steps your accountants can follow to evaluate internal controls, mitigate risks, and continuously improve processes, helping to safeguard your organization’s financial health and operational integrity.

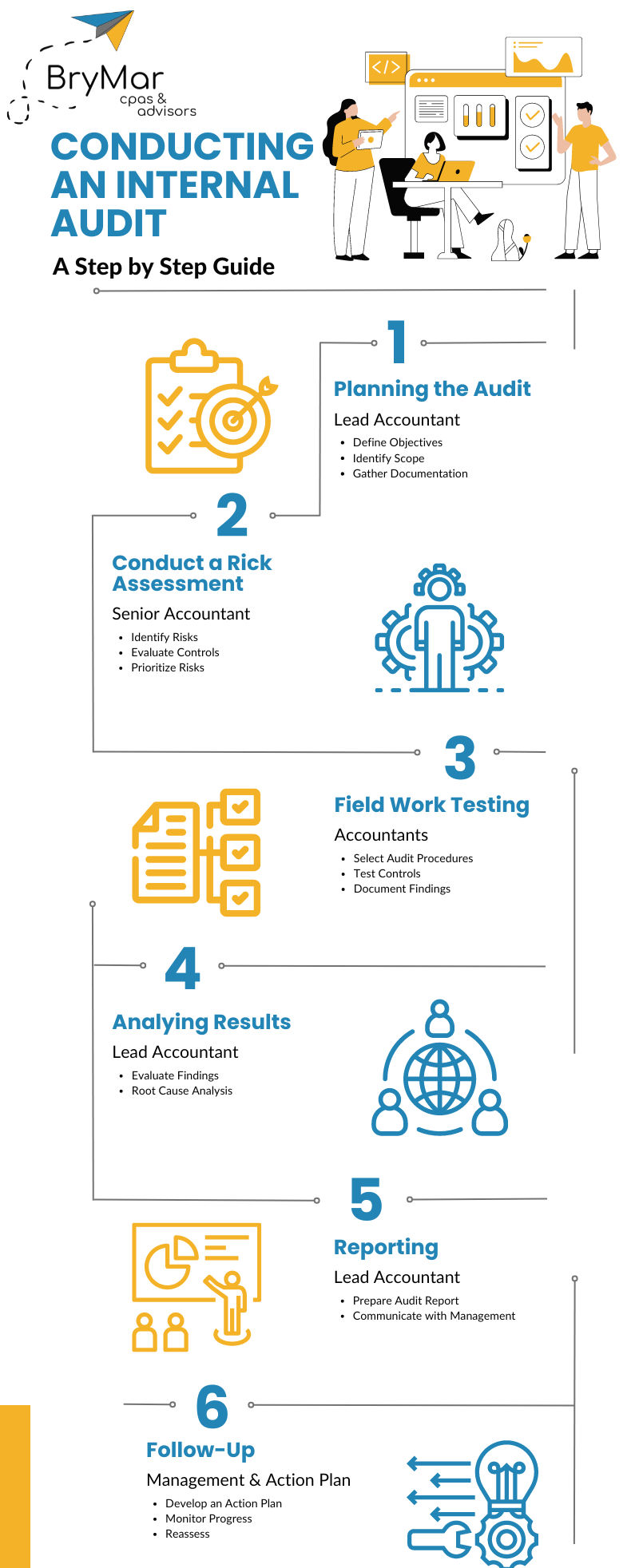

Step 1: Lead Accountant: Planning the Audit

Define Objectives: The Lead Accountant defines the purpose of the audit, whether it is to evaluate compliance, assess the effectiveness of internal controls, or identify areas for improvement.

Identify Scope: The Lead Accountant determines the specific areas, processes, or departments to audit, prioritizing high-risk or financially significant areas.

Gather Documentation: The Lead Accountant collects relevant policies, procedures, previous audit reports, and any other documentation necessary for the audit.

Step 2: Senior Accountant: Conducting a Risk Assessment

Identify Risks: The Senior Accountant lists potential risks that could impact the effectiveness of internal controls in the areas being audited.

Evaluate Controls: The Senior Accountant assesses the existing controls designed to mitigate these risks, considering both their design and operation.

Prioritize Risks: The Senior Accountant ranks risks based on their potential impact and likelihood, focusing on high-priority areas during the audit.

Step 3: Accountants: Fieldwork and Testing

Select Audit Procedures: The accountants determine the procedures to be used, such as interviews, document reviews, or process walkthroughs.

Test Controls: The accountants perform testing to evaluate whether controls are functioning as intended. This could include sampling transactions, verifying approvals, or reviewing reconciliations.

Document Findings: The accountants record observations, noting any instances where controls are not operating effectively or where risks are not adequately mitigated.

Step 4: Lead Accountant: Analyzing Results

Evaluate Findings: The Lead Accountant reviews the audit results, comparing them to the expected outcomes and identifying any gaps, weaknesses, or areas needing improvement.

Root Cause Analysis: The Lead Accountant investigates the underlying causes of any deficiencies, determining whether they are due to design flaws, non-compliance, or other factors.

Step 5: Lead Accountant: Reporting

Prepare an Audit Report: The Lead Accountant summarizes the findings, including the effectiveness of internal controls, identified risks, and areas for improvement. The report should also include recommended corrective actions.

Communicate with Management: The Lead Accountant shares the report with relevant management, ensuring that there is an understanding of the risks and the necessary steps to address them.

Step 6: Management and Accountants: Follow-Up

Develop an Action Plan: The management team works with the accountants to create a plan to address identified issues. This plan should include assigning responsibilities, setting deadlines, and outlining the steps for implementing improvements.

Monitor Progress: The management team and accountants regularly check in on the action plan's implementation to ensure corrective measures are being taken and controls are being strengthened.

Reassess: The lead accountant, along with management, plans for a follow-up audit or review to verify that improvements have been made and are sustainable.

This guide provides a structured approach to conducting an internal audit with a team of accountants, ensuring a thorough assessment of internal controls and identification of areas for improvement.

At BryMar CPA, we help our clients stay aware of and up-to-date on all regulatory requirements, ensuring their internal controls are robust and compliant with the latest standards. Contact us to discuss your needs.

Download a Copy of the Guide